OPPENHEIMER HOLDINGS (OPY)·Q4 2025 Earnings Summary

Oppenheimer Delivers Record Q4 as Investment Banking Surge Drives 593% EPS Gain

January 30, 2026 · by Fintool AI Agent

Oppenheimer Holdings Inc. (NYSE: OPY) reported record quarterly and full-year earnings for Q4 2025, with net income of $74.4 million ($7.08 basic EPS) compared to just $10.7 million ($1.04 basic EPS) in Q4 2024—a 593% increase. Revenue reached $472.6 million, up 25.9% year-over-year, as a resurgent Capital Markets business delivered near-record results and Wealth Management benefited from record-high assets under management.

Did Oppenheimer Beat Earnings?

Oppenheimer delivered a blowout Q4, posting record results across virtually every key metric:

For the full year 2025, Oppenheimer reported revenue of $1.6 billion (+14.4% YoY) and net income of $148.4 million (+107.4% YoY), with basic EPS of $14.13—more than double the prior year.

What Drove the Record Quarter?

The dramatic earnings improvement was driven by two key factors:

Capital Markets Turnaround

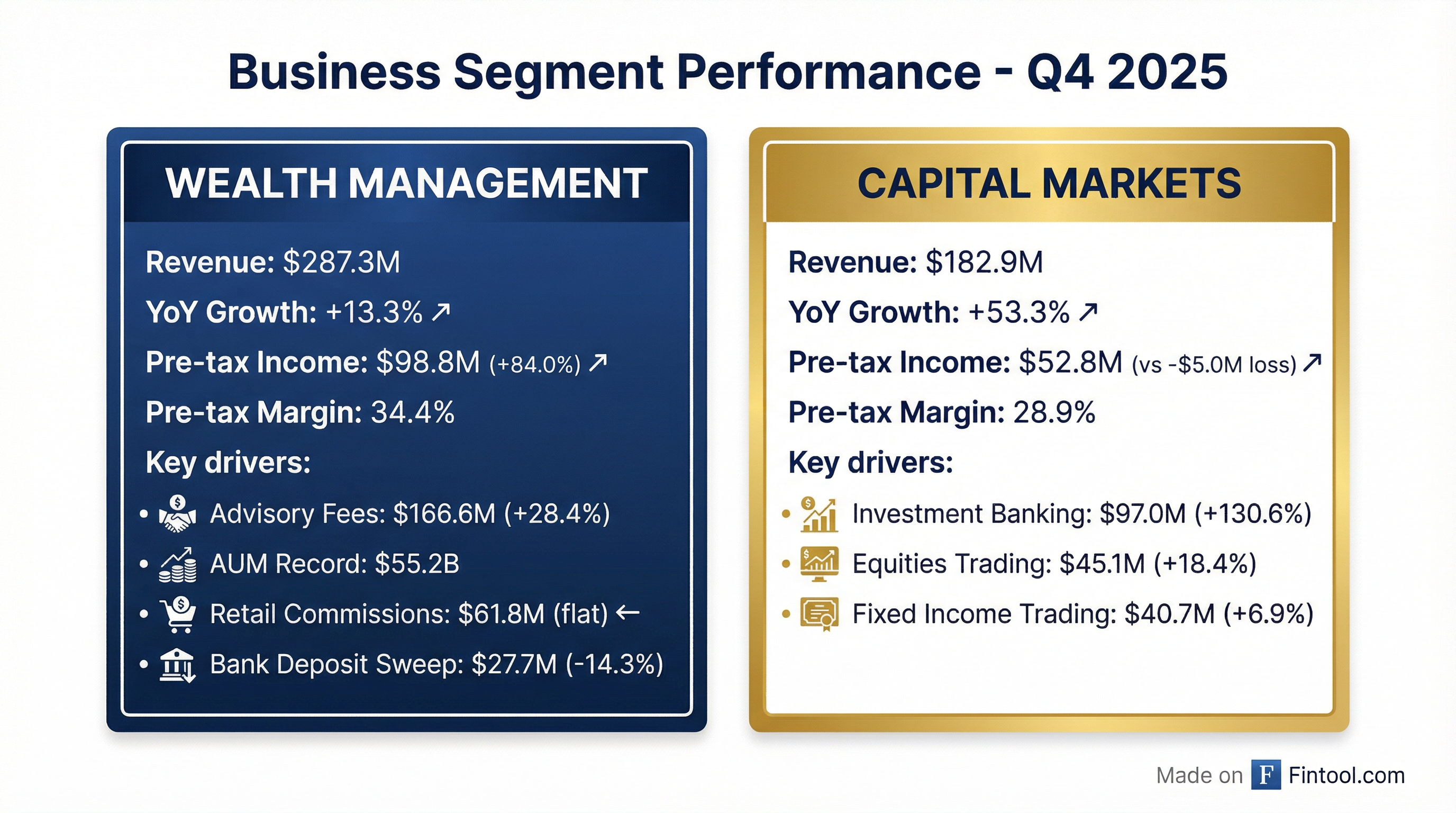

Capital Markets revenue surged 53.3% to $182.9 million, swinging from a $5.0 million pre-tax loss in Q4 2024 to a $52.8 million pre-tax profit.

Investment banking was the standout performer:

- Advisory fees increased 41.3% to $42.8 million due to greater M&A and restructuring deal participation

- Equity underwriting jumped $38.7 million higher YoY, driven by healthcare and technology sector transactions

- Fixed income underwriting rose 71.8% from increased public finance activity

Sales and trading also contributed, with equities trading up 18.4% and fixed income up 6.9% on higher volumes.

Wealth Management Strength

Wealth Management delivered revenue of $287.3 million (+13.3% YoY) with pre-tax income of $98.8 million (+84.0% YoY).

Key drivers included:

- Advisory fees surged 28.4% to $166.6 million on higher AUM valuations and incentive fees from alternative investments

- AUM reached a record $55.2 billion, up $5.8 billion from year-end 2024

- Retail commissions held steady at $61.8 million

- Bank deposit sweep income declined $4.6 million due to lower short-term rates and reduced balances

What Did Management Say?

CEO Robert S. Lowenthal highlighted the favorable market environment and the firm's execution:

"The Firm's operating results for the fourth quarter and full year 2025 were much improved. We achieved record full year and quarterly earnings per share with increased revenues driven by broad-based strength across our core businesses."

Lowenthal pointed to several macro tailwinds:

- Equity markets rallied for a third consecutive year of double-digit gains

- Fed accommodation and strong corporate earnings supported risk appetite

- AI investment enthusiasm provided additional market lift

On the outlook, he noted: "Looking ahead, our Firm remains well-positioned to navigate evolving market and economic conditions and capitalize on opportunities across our businesses. As we enter 2026, we believe that the momentum is likely to continue providing strong underpinnings to the equity markets and to results within our investment banking franchise."

Capital Allocation and Shareholder Returns

Oppenheimer demonstrated confidence in its balance sheet by returning capital to shareholders:

The firm's capital position strengthened significantly:

- Stockholders' equity: $983.8 million (record)

- Book value per share: $93.81 (record)

- Tangible book value per share: $76.78 (record)

- Regulatory excess net capital: $457.8 million

How Did the Stock React?

OPY shares closed at $76.21 on January 29, 2026, trading near the middle of its 52-week range ($49.26 - $82.39). The stock has appreciated significantly from its 2024 lows, reflecting the improving earnings trajectory.

The stock trades at roughly 1.0x tangible book value, a modest premium to historical levels but well below the firm's 2021-2022 valuation multiples.

What Changed From Last Quarter?

The sequential acceleration was driven almost entirely by investment banking, which nearly doubled from Q3 as the M&A and equity issuance markets remained active through year-end.

Full Year 2025 Summary

For the full year, Capital Markets swung from a $39.6 million pre-tax loss to a $56.2 million pre-tax profit—a $96 million improvement driven by the revival of investment banking activity.

Forward Catalysts

Key factors to watch for Oppenheimer in 2026:

- Investment Banking Pipeline: Continued M&A and equity issuance activity is critical to sustaining Capital Markets momentum

- AUM Growth: Equity market performance will drive advisory fee revenue

- Interest Rates: Lower rates pressure bank deposit sweep income but may support deal activity

- Expense Management: Compensation ratio improved to 62.1% from 65.4% YoY

Key Takeaways

- Record Q4 and full-year earnings: EPS of $7.08 (Q4) and $14.13 (FY 2025) both all-time highs

- Capital Markets turnaround: Investment banking more than doubled, driving segment to profitability

- Wealth Management steady: Record AUM of $55.2B supports advisory fee growth

- Shareholder returns: $1.00 special dividend plus ongoing buybacks

- Strong balance sheet: Book value at $93.81 per share, record high

The firm appears well-positioned to benefit from continued strength in capital markets activity, though results remain highly correlated to market conditions and deal flow.